Take into account that selling your house at a decline can nonetheless incur tax obligations. Generally, canceled – or forgiven – personal debt is considered taxable earnings. Which will consist of a short sale, foreclosure, deed in lieu of foreclosure, or personal loan modification.

After you’ve finalized the provide, another action is to close the deal. Real-estate Lawyers or Dallas title firms act as closing agents. Have a Observe of The prices you'll want to shell out when closing the offer:

Price of mortgage curiosity: Firstly of one's financial loan, a bigger percentage of your respective house loan payment goes towards fascination. Therefore, you’re not accumulating Substantially fairness in the house in the event you sell way too before long.

When you've owned the house for at least twelve months — even if you don't live there for the entire year — your sale qualifies for extensive-term capital gains tax charges. Very long-term charges are generally Substantially lower for many sellers.

But it’s 2025. Selling a house in the Big D Metropolis is easier than in the past. You don’t need an entire-commission real estate agent to receive leading dollar for your house. Comply with these basic actions to record on MLS in Texas, appeal to buyers rapidly, and conserve hundreds!

Nevertheless, for the most part, it always will depend on the exact period of time you individual the residence, including in the next situations:

Tax Submitting position: If you are married and filing a joint tax return then the amount exempted increases to $five hundred,000 and will likely be thought to be tax-free of charge.

If you need out quick, an even better idea is likely to be to lease the house. If you really can't prevent selling, selling having why not find out more a 1% Fee real estate agent can assist you help you save large on real estate agent service fees.

If you are in a higher tax bracket and be expecting to show An important income, the distinction between selling inside of 6 months vs. selling after one particular year could possibly be tens of thousands of dollars.

Often you can’t keep away from selling a house Soon after purchasing. Below are a few techniques to produce the very best of this next kind of circumstance:

Unforeseen situations signaling the need to move inside of a year of buying a home can prompt issues: “Has my household appreciated more than enough which i can make a revenue … or split even?” or “Can I sell a house after possessing it for a single year?”

Whenever you sell your house to HomeGo, we have been devoted to helping you fully grasp our method. go to my site We’re not intending to throw a lot of quantities at you, modify Those people numbers numerous situations, and after that be expecting you to pay for dozens of concealed fees. Ignore the tension that accompanies the standard technique for selling your house.

» Understand: The amount does it cost to sell a house? three. Compute your prospective capital gains tax legal responsibility

Craft a Captivating Assets Description: A perfectly crafted listing will capture buyer desire. Produce a catchy headline with an interesting description and don’t overlook to use adjectives like “flawless” and “roomy” to entice consumers.

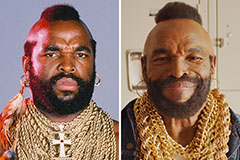

Mr. T Then & Now!

Mr. T Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!